Making Tax Digital (MTD for ITSA) for Self-Employed Car Dealers

The Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is a scheme introduced by HMRC, designed to digitise the income-tax self-assessment process. Under the scheme, sole traders and landlords with qualifying income must maintain digital records and submit quarterly updates to HMRC via approved software.

This blog will explain what qualifies as "qualifying income", outline the phased introduction, choosing HMRC-approved software, and how MotorDesk supports streamlining compliance for your used car dealership.

What is Qualifying Income?

Under the MTD for ITSA programme, "qualifying income" refers to the total gross income reported in a tax year from:

- Self-employment (sole-trader trading) and/or

- Property letting

As it is based on the gross income (turnover) rather than taxable profit, this means that even if your allowable expenses are high, you may still fall within the scope if the turnover exceeds the HMRC's thresholds.

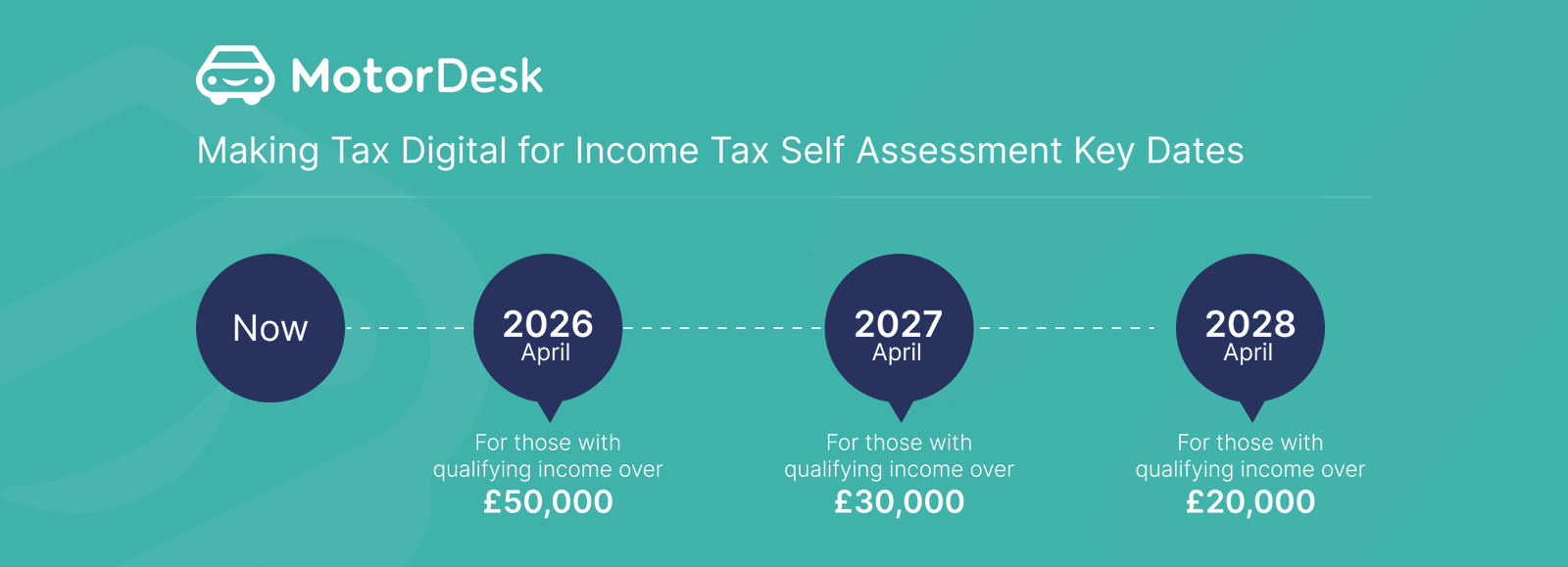

Phased Introduction of MTD for ITSA

The scheme will be introduced in stages as follows:

- From April 2026 : Individuals with qualifying income exceeding £50,000 will be required to comply.

- From April 2027 : The requirement will extend to those qualifying income above £30,000.

- From April 2028 : The threshold is expected to reduce further, bringing individuals with qualifying income over £20,000 into scope, subject to legislation.

Compatible Software

MotorDesk is the only car dealership software that integrates directly with and is fully certified by the UK's top car dealership accounting platforms:

- Sage Cloud Accounting

- Intuit QuickBooks

- Xero Accounting

All three are compatible with submitting MTD for ITSA to HMRC. Using MotorDesk car dealership software and your accounting software together streamlines your submissions for compliance under this new scheme.

If you use a different accounting software, HMRC provides an online tool identifying which solutions are compatible with MTD for ITSA.

You can access the official tool here: https://www.gov.uk/guidance/find-software-thats-compatible-with-making-tax-digital-for-income-tax

What This Means For You

If you fall within the scope of MTD for ITSA, you will need to submit quarterly summaries of your income and expenses. These updates must be filed by the 7th of the month following the end of each quarter.

By 31st January following the end of the tax year, you will need to submit a final declaration. This will be similar to the current self-assessment return, but will be pre-populated with the quarterly submissions you have made. You will only need to input any further adjustments you may have.

Key Dates for the 2026-2027 Tax Year

- 6th April 2026

Mandatory start date for keeping records using MTD-compatible software. - 7th August 2026

First quarterly update deadline (For the period 6th April to 5th July). - 7th November 2026

Second quarterly update deadline (For the period 6th July to 5th October). - 7th February 2027

Third quarterly update deadline (For the period 6th October to 5th January). - 7th May 2027

Fourth quarterly update deadline (For the period 6th January to 5th April). - 31st January 2028

Final Declaration.

How MotorDesk Supports MTD Compliance

Overall, these changes mean that more business owners will be required to record and submit reports, and to do so more frequently.

MotorDesk car dealership software allows you to be fully supported by ensuring your sales and stock records are seamlessly transferred into Xero, Sage or Quickbooks in the correct format. This reduces the need for manual entry and reconciliation, allowing you to focus on selling cars and growing your business.

As compliance obligations continue to increase across the industry, using MotorDesk helps future-proof your business by ensuring your financial data is ready for evolving HMRC digital tax records.

Get Started

If you're interested in trying the MotorDesk car dealership software we offer a full 30-day free trial!